A credit score summarises all the details contained in your credit report. It is a numerical value between 300 and 850 and is an indicator of risk level.

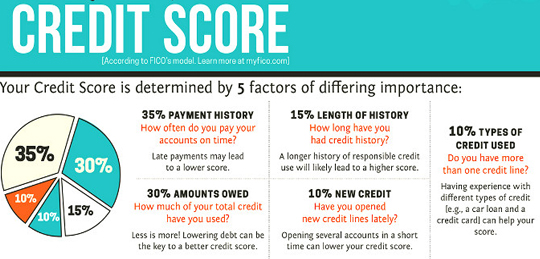

How your credit score is calculated:

35% is based on past repayments

This examines timely payments and is the major deciding factor.

30% examines how much you actually owe

If you have used too much of what you have available, you are a high risk. If you regularly exceed limits, this will be reflected.

15% is about the amount of time for which you have had credit

This evaluates how long you have had credit. If you have just recently established a record for yourself, then this will be indicated here.

10% examines additional credit you have taken on

If you have applied for too many accounts, this will have a negative effect, as it is an indicator of possible financial distress.

10% explores the kinds of credit used

Responsibility in terms of managing more than one account is monitored here. If you have various debt obligations settled on time and in full, this will bump your score up.

How your credit score is calculated may also differ from one credit bureau to another. Ultimately, this numerical value is pivotal is credit-granting decisions. If you want to apply for a car loan and you don’t qualify on account of your status, then you should work on getting to an excellent level. This way, you can avoid rejection, which could potentially lower your score further.

If there are report errors this will affect how you are scored, so you need to be prudent about making sure that these are fixed.