Wonga Loans are renowned for offering clients flexibility and easily accessible cash solutions. The advent of Payday loans in the financial industry in South Africa has been a refreshing addition. They have provided individuals with more options for getting the cash they need.

Wonga Loans is a registered financial institution that has been providing options to clients in South Africa since 2012. Since then it has provided over a million loans to individuals, giving them help when they are experiencing cash flow problems. Specialising in speedy response times, Wonga gives clients an easy way apply for the loans. There are no long bank queues or long application forms to tackle. Wonga plans to transform the South African credit market by offering more flexibility than traditional lenders.

To get access to Wonga Loans:

- Visit the website www.wonga.co.za

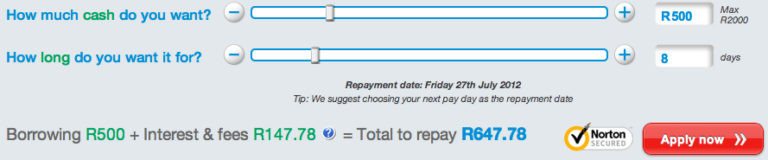

- Use the sliders to decide how much you need and for how long you will be needing the finance

- Wonga will do some necessary credit checks

- Wonga will send you an interest-free quote

- Should you accept it, you can expect the small cash injection on the same day as your application

Wonga provides unsecured loans to clients so they don’t have to worry about putting any of their personal assets up as surety for the loan.

Wonga delivers instant cash when you need it. You will need to ensure that there are enough funds available in your account on your selected repayment date.

Why choose Wonga as your Payday loan solution?

- You get an instant financial boost

- Applications are simple and easy to access

- There is no complicated paperwork

- There are no time-consuming in-branch visits or face-to-face interviews

- Wonga is a registered credit provider, so you can rely on their honest lending processes. Wonga’s operations are compliant with the National Credit Act.

- You don’t have to provide any collateral

Online loan calculator.