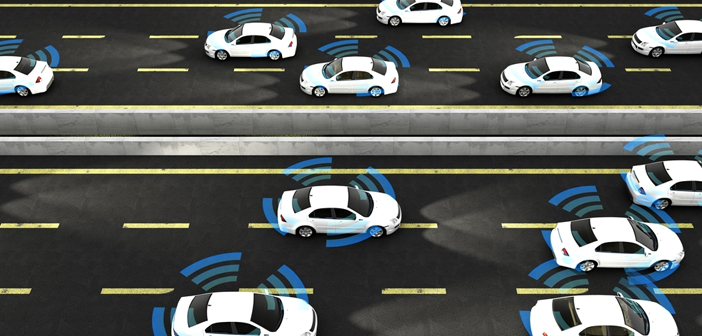

The emergence of the new technology of self-driving cars has had tongues wagging.

Vehicles that regardless of your ability to drive are capable of sensing their environment and navigating without human input, whether you’re aging or visually impaired you can get around easily and safely with a self-driving car.

And companies such as BMW, Mercedes, and even tech company, Google have already released or are soon to release self-driving vehicles.

If you have tuned in to your favourite drive time radio show you would have heard the DJ mention something about self-driving cars. A perfect time to talk about this considering it’s in that moment when you’re driving home in your car usually stuck in traffic that you’d envision yourself being in a self-drive car.

Sounds exciting right? But such advancement can also bring about disruption to the shared economy, most specifically car insurance industry.

The insurance industry, which usually protects you from any and everything under the sun, has however been slow to adjust to such massive and widespread change and in turn leaving many in the dark concerning coverage. Such as who’s to blame for an accident involving self-driving cars, a new wave of technology that needs to be integrated into insurance policies.

And also on the other hand self-driving car tests show a promising safety factor in the future, which means car insurance premiums, could drop by more than half in the next decade or two.

Especially since an in-depth report from Business Insider (BI) Intelligence stated that 10 million self-driving cars will be on the road by 2020.

Thus, an opportunity presents itself for newcomers to take the place of traditional car insurance companies, or for traditional car insurance companies to adjust. Only time will tell.